本文首发于智堡公众号:zhi666bao。

Introduction

介绍

John Maynard Keynes is credited with saying, “When the facts change, I change my mind. What do you do, sir?” Over the past decade, policymakers across the globe have been focused on getting their economies and financial systems back in order. But at the same time, a sea change in supply-side realities has taken place. These changes have redefined what is achievable, and challenged conventional wisdom on monetary policy.

凯恩斯曾说,“当现实改变了,我会改变想法,而阁下会如何做?“在过去的十年里,全球的政策制定者一直专注于恢复经济和金融体系。但与此同时,供给侧的现实发生了翻天覆地的变化。这些变化重新定义了可实现的目标,并挑战了货币政策的传统观念。

Shifting demographic trends and a slowdown in productivity are driving slower trend growth and historically low levels of real interest rates across the globe. This new set of facts requires us to rethink what we once knew, reassess how to best foster strong and stable economies, and ready ourselves for the future.

人口趋势的变化和生产率的下降使全球增长趋势放缓,并将实际利率推至历史低位。在这些全新的现实面前,我们不得不重新审视自认为已知的事实,再度思考提振经济的最佳方案,从而为将来做好准备。

With that start, it’s time I remind everyone that the views I express today are mine alone and do not necessarily reflect those of the Federal Open Market Committee or others in the Federal Reserve System.

我今天表达的是我个人的观点,不代表联邦公开市场委员会或其他美联储同僚的观点。

The Road to Recovery

复苏之路

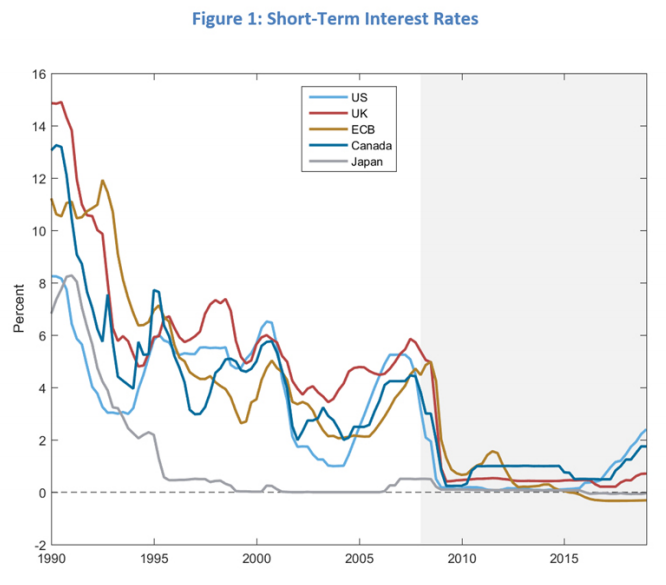

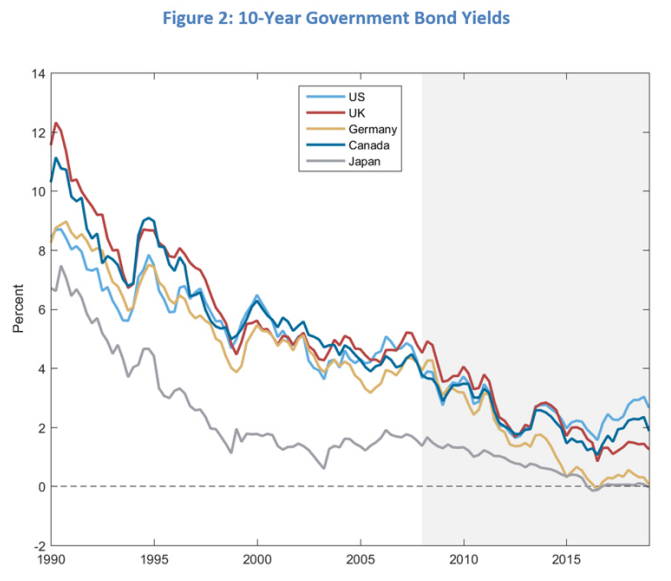

Following the global financial crisis, central banks took bold and decisive actions to right their economies and bring them back to health. Short-term interest rates were brought to near zero—in some cases below zero—and held there for many years (Figure 1). The combination of low short-term rates and asset purchase programs has driven yields on long-term sovereign debt to historically low levels (Figure 2). In large parts of Europe and Japan, short- and long-term yields remain near zero, a full decade after the onset of the financial crisis.

在全球金融危机之后,各国央行采取了大胆而果断的行动来维护经济并使其恢复健康。许多年以来短期利率都接近于零 - 甚至在某些情况下低于零(图1)。低短期利率和资产购买计划的结合将长期主权债务的收益率推至历史低位(图2)。金融危机爆发后的整整十年后,在欧洲的大部分地区以及日本,短期和长期收益率仍然接近于零。

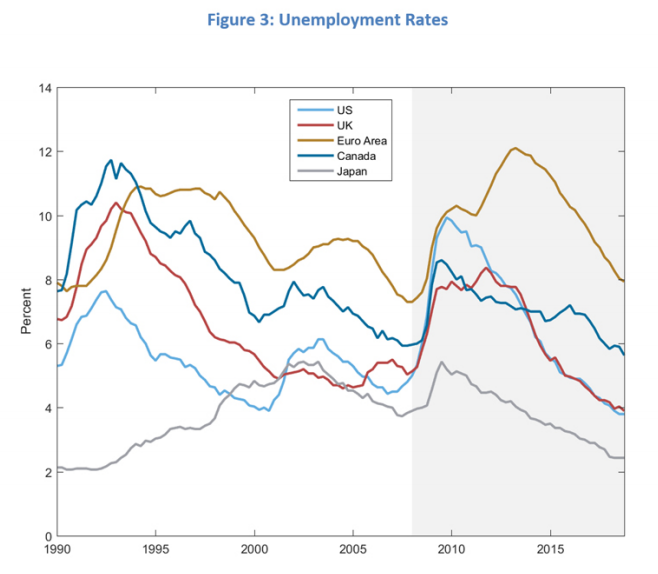

Economic developments since this unprecedented monetary stimulus provide valuable insights into the efficacy and limitations of monetary policy. On the positive side of the ledger, advanced economies have seen steady growth and significant declines in unemployment, with rates today near, or in many cases well below, those seen before the crisis (Figure 3). Bold monetary policy actions surely played an important role in averting far greater catastrophes and aided economic recovery.

在这种空前的货币刺激措施下,经济得到了发展;同时也为货币政策的有效性和局限性提供了宝贵的洞见。从积极方面看,在目前利率水平接近或远低于危机前的环境下,发达经济体实现了稳定的增长和失业率的显著降低(图3)。这些大胆的货币政策无疑帮助我们避免了更大的灾难,并在经济复苏方面发挥了重要作用。

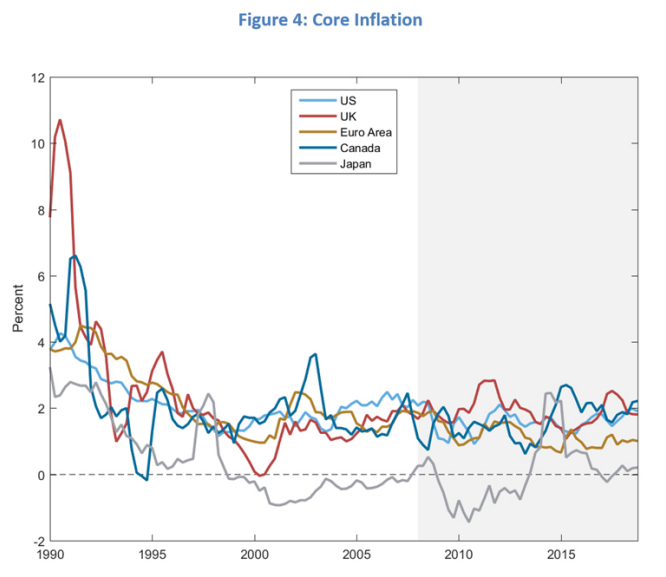

However, this success was achieved only after a disappointingly slow recovery and many years of economic hardship. And, despite the improvement in the real side of economies, inflation rates have persistently been below central banks’ goals (Figure 4). The fact that inflation has been running below target in most advanced countries—the United Kingdom being the most prominent outlier—suggests that this challenge is not due to factors specific to a single country. Instead, there are more systemic factors at play.

然而,在成功之前我们还经历了一段令人失望的缓慢复苏期和多年经济困难。而且,尽管实体经济有所改善,但通胀率一直低于央行的目标(图4)。事实上,大多数发达国家的通胀率一直低于目标 - 英国更是其中的代表 - 这表明我们面临的挑战并非某个国家的特例。相反,其中有更多的系统因素在发挥作用。

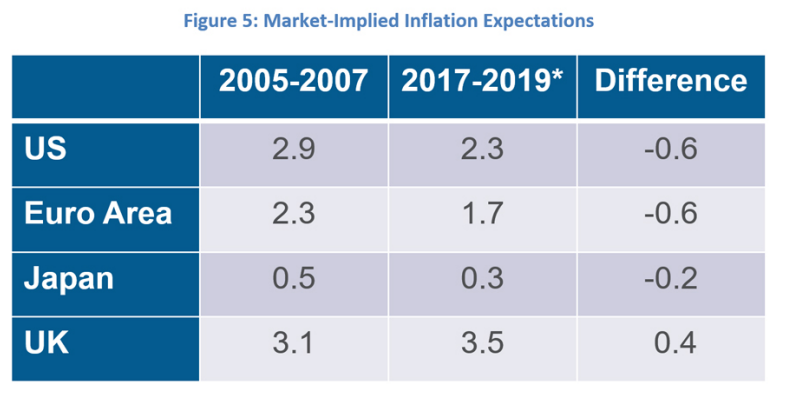

Investors view these low inflation readings not as an aberration, but rather a new normal. This is evidenced by a broad-based decline in market-based measures of longer-run inflation expectations since the mid-2000s, with the UK again providing the exception (Figure 5).

一些投资者认为这些低通胀数据并非一种失常,而是一种新常态。自2000年代中期以来基于市场的长期通胀预期指标广泛下降就证明了这一点,而英国再次是例外(图5)。

This experience of slow recovery and persistently low inflation is a symptom of a deeper problem afflicting advanced economies—the root cause of which is a combination of low neutral interest rates and the lower bound on interest rates, a topic to which I now turn.

在我看来,这种缓慢复苏和持续的低通胀只是一个表征,真正影响发达经济体的是一个更深层次的问题 - 其根本原因是低中性利率和利率下限的结合,我现在转向这个话题。

What’s Past Is Prologue

过去是序幕

Underlying these events has been a sea change in the supply side of economies, owing to fundamental shifts in demographics and productivity growth.

这些事件的背后隐藏着供给端的巨变,是由人口结构和生产率增长的根本性转变导致的。

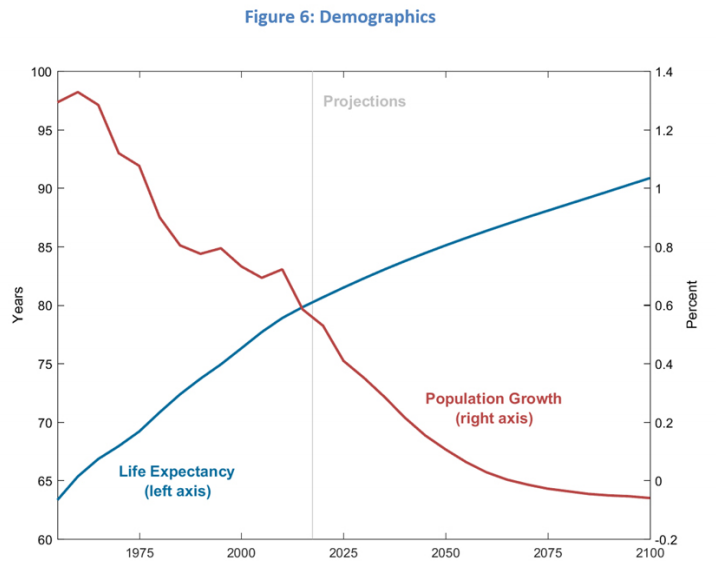

Two demographic trends are evident: People are generally living longer and population growth is slowing. Overall life expectancy in member countries of the Organisation for Economic Co-operation and Development (OECD) has increased from about 65 years in the 1950s to nearly 80 years today, and is projected to exceed 90 years by the end of this century (Figure 6). Despite this increase in longevity, dwindling birth rates are bringing population growth to a standstill. In OECD countries, population growth averaged over 1 percent back in the 1950s and 1960s, but is now running at half a percent per year, and is expected to gradually fall before dipping into negative figures by 2070 (Figure 6).

在人口问题上,有两个十分明显的变化趋势:人们的寿命更长;而人口增长则正在放缓。经济合作与发展组织(OECD)成员国的总体预期寿命从1950年代的大约65岁增加到今天的近80年,预计到本世纪末将超过90岁(图6)。尽管寿命有所增加,但出生率的下降正在使人口增长陷入停滞。同样是OECD国家,在20世纪50年代和60年代时的人口增长平均超过1%,但现在已降至0.5%,预计到2070年之前会进一步下降,直至进入负增长(图6)。

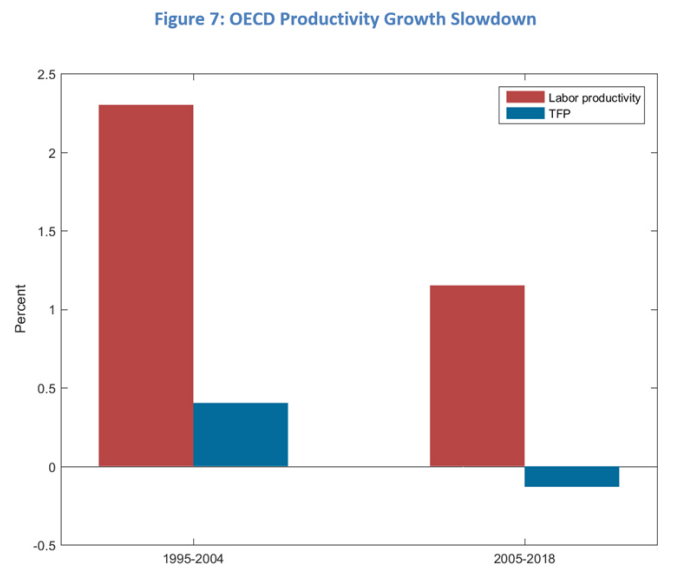

When it comes to productivity, the changes are no less dramatic. In OECD economies, growth in labor productivity—the amount produced per worker hour—has averaged a little over 1 percent per year since 1995, about half the pace seen over the prior decade (Figure 7). A major factor driving the slowdown is a dramatic decline in the growth rate of “total factor productivity,” or TFP, a measure of innovation and technological change.

生产率方面同样出现了不少戏剧性的变化。在OECD经济体中,04-18年间劳动生产率(工人每小时的产量)的增速水平维持在1%左右,相比之前十年下降了近一半(图7)。造成经济放缓的一个主要因素是“全要素生产率”(TFP)增速的急剧下降,TFP是衡量创新和技术变革的标准。

As Bob Gordon has taught us, U.S. productivity growth tends to cycle between periods of high growth in decades following fundamental breakthroughs in science and technology, and relatively fallow periods of steady, incremental improvements. All the evidence indicates that we are in one of the latter periods of “normal” productivity growth of 1 - 1.5 percent per year, and that things will likely stay that way until the next scientific or technological revolution.

正如鲍勃戈登告诉我们的那样,美国的生产率增长趋势往往会在科学和技术的根本性突破、数十年的高速增长以及稳定的渐进式改善三个阶段之间循环。所有的证据都表明,我们正处于生产力“正常”增长的后期阶段之中 - 增速将维持在每年1 - 1.5%,直到下一次科学或技术革命出现。

R-star Descends

自然利率下降

These global shifts in demographics and productivity have two important implications for the future of our economies and for monetary policy. First, slower population and productivity growth translate directly into slower trend economic growth. Second, these trends have contributed to dramatic declines in the longer-term normal or “neutral” real rate of interest, or r-star.

这些全球人口和生产力的变化将对未来的经济和货币政策产生两个重要的影响。首先,人口减少和生产率增长将直接导致经济增长趋势进一步放缓。其次,这些趋势导致中性利率 - 即r-star的长期大幅下降。

Slower trend growth reduces the demand for investment, while longer life expectancy tends to increase household saving. This combination of lower demand for and higher supply of savings, along with other factors, has pushed down r-star. With open capital markets, these global changes in supply and demand affect r-star globally.

较慢的趋势增长减少了对投资的需求,而较长的预期寿命往往会增加家庭储蓄。这种低需求和高供应的储蓄结构以及其他因素的结合推动了自然利率的下滑。在开放的资本市场,这些全球供需变化无疑正影响着自然利率。

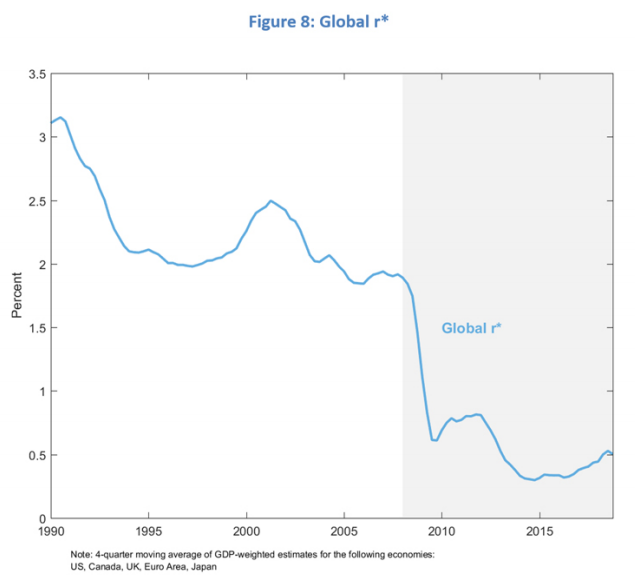

The evidence of a sizable decline in r-star across economies is compelling. The weighted average of estimates for five major economic areas—Canada, the euro area, Japan, the United Kingdom, and the United States—has declined to half a percent (Figure 8). That’s 2 percentage points below the average natural rate that prevailed in the two decades before the financial crisis. A striking aspect of these estimates is that they show no signs of moving back to previously normal levels, even though economies have recovered from the crisis. Given the demographic waves and sustained productivity growth slowdown around the world, I see no reason to expect r-star to revert to higher levels in the foreseeable future.

各经济体自然利率大幅下降的证据确凿。五个主要经济体 - 加拿大,欧元区,日本,英国和美国 - 的加权平均自然利率已降至0.5%(图8)。这比金融危机前二十年的平均水平低了2个百分点。一个要点则是,尽管经济已经从危机中恢复过来,但却没有恢复到此前正常水平的迹象。鉴于世界各地的人口波动和持续的生产率增长放缓,我不认为自然利率能在可预见的未来内恢复到更高的水平。

The global decline in r-star will continue to pose significant challenges for monetary policy. Given the limited policy space for interest rate cuts in future downturns, recoveries will be slow and inflation below target. The limitation in the ability of central banks to offset downturns results in an adverse feedback loop, whereby expectations of low future inflation drag down current inflation and further reduce available policy space.

全球自然利率下滑将继续对货币政策构成重大挑战。鉴于未来经济衰退期间降息的政策空间有限,复苏步伐可能放缓,通胀率将低于目标水平。央行对抗衰退的能力受限将导致恶性循环,对未来低通胀的预期会拖累目前的通胀并进一步减少可用的政策空间。

New Facts, New Approaches

新事实,新方法

Policymakers around the globe need to prepare for the challenges of navigating the new realities of slow global growth and low r-star. This necessitates new thinking and approaches to monetary, fiscal, and other economic policies.

全球政策制定者需要做好准备,以应对全球经济增长缓慢和低迷的新现实所带来的挑战。这需要对货币,财政和其他经济政策采取新的思路和方法。

Starting with monetary policy, central banks should revisit and reassess their policy frameworks, strategies, and toolkits, to maximize efficacy in a low r-star world. The Bank of Canada already regularly does this, and the Federal Reserve is currently undergoing a review of its framework and strategy.8 Absent such changes, central banks will be severely challenged to achieve stable economies and well-anchored inflation expectations.

货币政策只是开始,中央银行应该重新审视并重新评估其政策框架,策略和工具箱,以便在低自然利率的环境中最大限度地提高效率。加拿大央行已经定期这样做,美联储目前正在对其框架和策略进行审查。如果不这样做,央行将在实现稳定的经济和良好的通胀预期时面临严峻的挑战。

Outside of monetary policy, there are a number of avenues by which fiscal authorities can enhance the resilience of economies to negative shocks. One is to strengthen the “automatic stabilizers” that provide a boost to the economy during a downturn. A second is to align debt management decisions more with monetary policy. For example, during a downturn, the fiscal authority could choose to shorten the duration of debt issuance to reinforce the effects of central bank quantitative easing. Third, regulatory and supervisory policies that support the resilience of the financial system can limit the economic effects of negative shocks.

在货币政策之外,财政当局可以通过多种途径增强经济对负面冲击的抵御能力。一个是加强“自动稳定器”,在经济衰退期间提振经济。第二是将债务管理决策更多地与货币政策结合起来。例如,在经济低迷时期,财政部门可以选择缩短债务发行期限,以加强央行量化宽松政策的效果。第三,出台支持金融体系复原的监管政策可以限制负面冲击带来的经济影响。

Finally, fiscal and other economic policies can attack directly the sources of slow growth and low r-star. This includes raising public and private investment in human and physical capital, infrastructure, science and technology, and policies aimed at removing barriers to participation in the labor force and the economy more broadly.

最后,可以制定直面低增长和低自然利率根源的财政和其他经济政策。这包括提高公共部门和私人部门对人力资源、实物资本、基础设施以及科技的投资,并出台相关政策,旨在消除藩篱使其能更广泛地参与劳动力和经济市场。

Conclusion

结论

The facts have changed, and so it is time our change our minds also. It is often said that change is hard. But, experience teaches us that it is better to prepare for the future than wait too long. Ultimately, failure to prepare often means preparation for failure.

现实已经改变,所以现在是我们改变思路的时候了。人们常说改变很难。但是经验告诉我们,提前准备好过空等。毕竟,机会永远留给有准备的人。

声明:本文仅代表作者个人观点,不代表智堡立场;文中图片来源于网络,如有侵权烦请联系我们,我们将在确认后第一时间删除,谢谢!

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号